You’re in the right place if you’re struggling with…

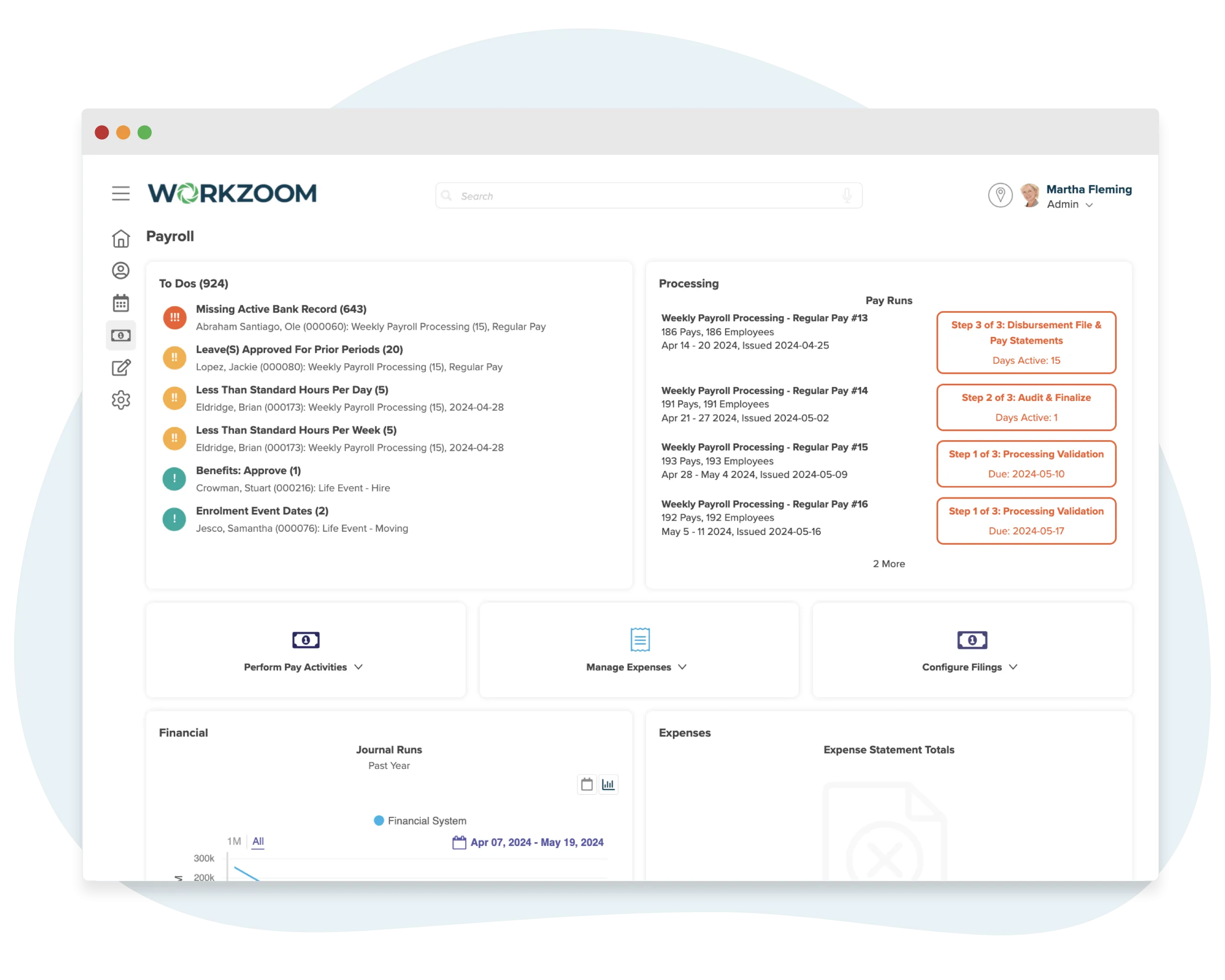

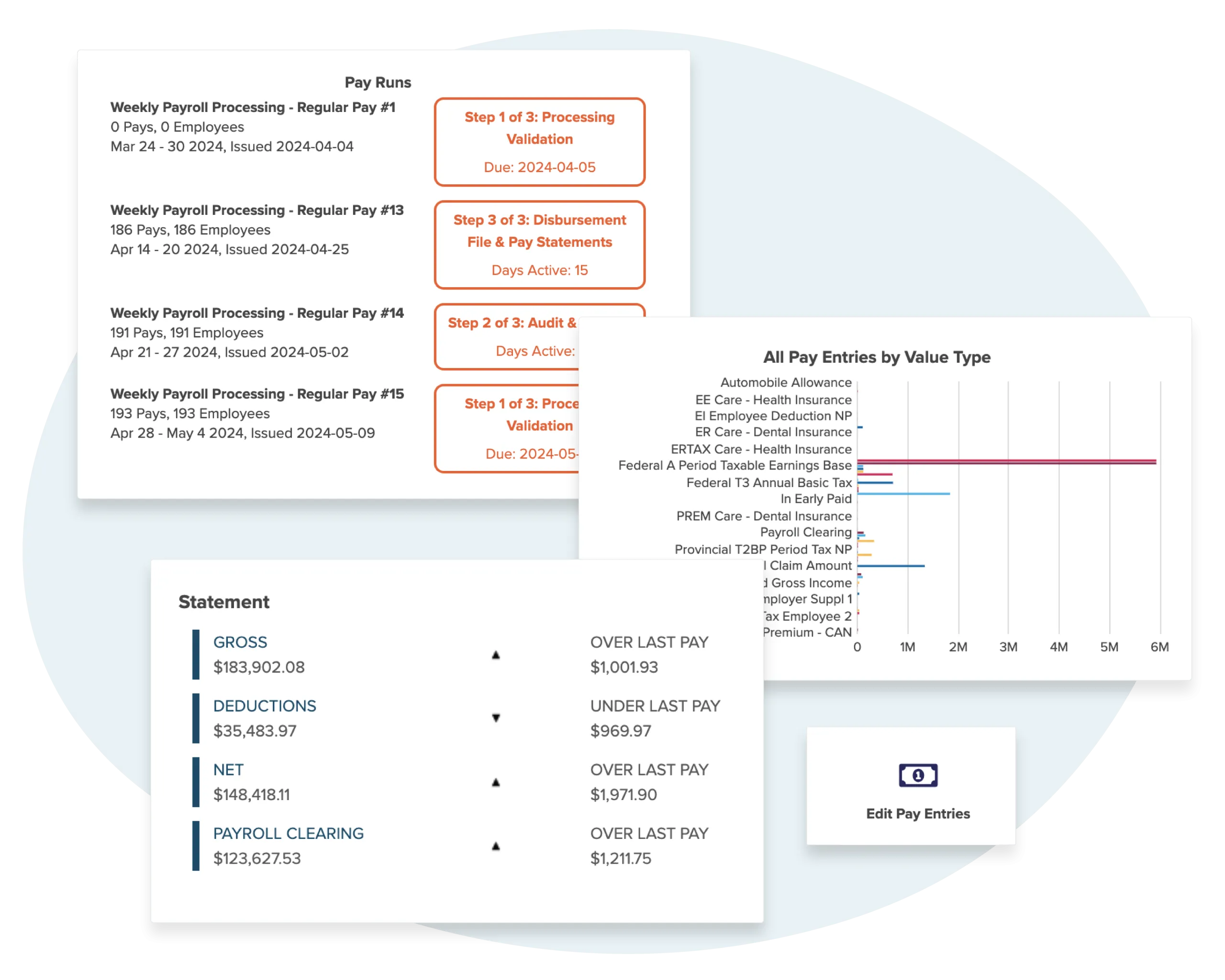

Automated Data Collection

Pay accurately and on-time.

Ensure payroll calculations are accurate and consistent while efficiently gathering and processing employee work hours, leave, and other pay-related data to save time and reduce the workload on payroll admin. Enjoy real-time data access and analysis to ensure employee payments are correct and disbursed on time.

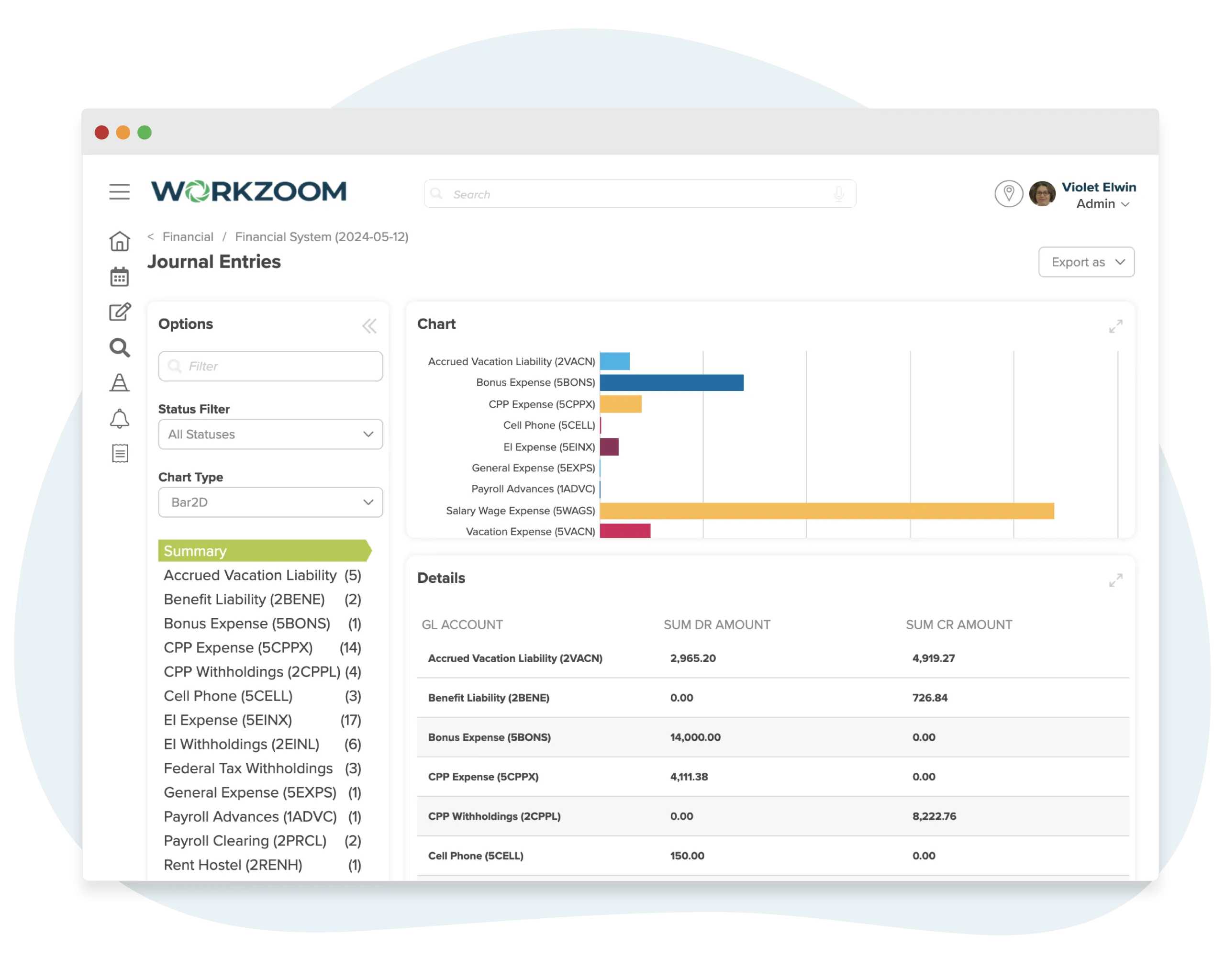

Financial Analysis

Analyze and attribute all costs.

Maximize your analysis capability by aligning your payroll software and financial system. Get precise, real-time insight into where and how money is being spent, facilitating better budget management and cost control. Support strategic decision-making through detailed financial visibility to labor costs.

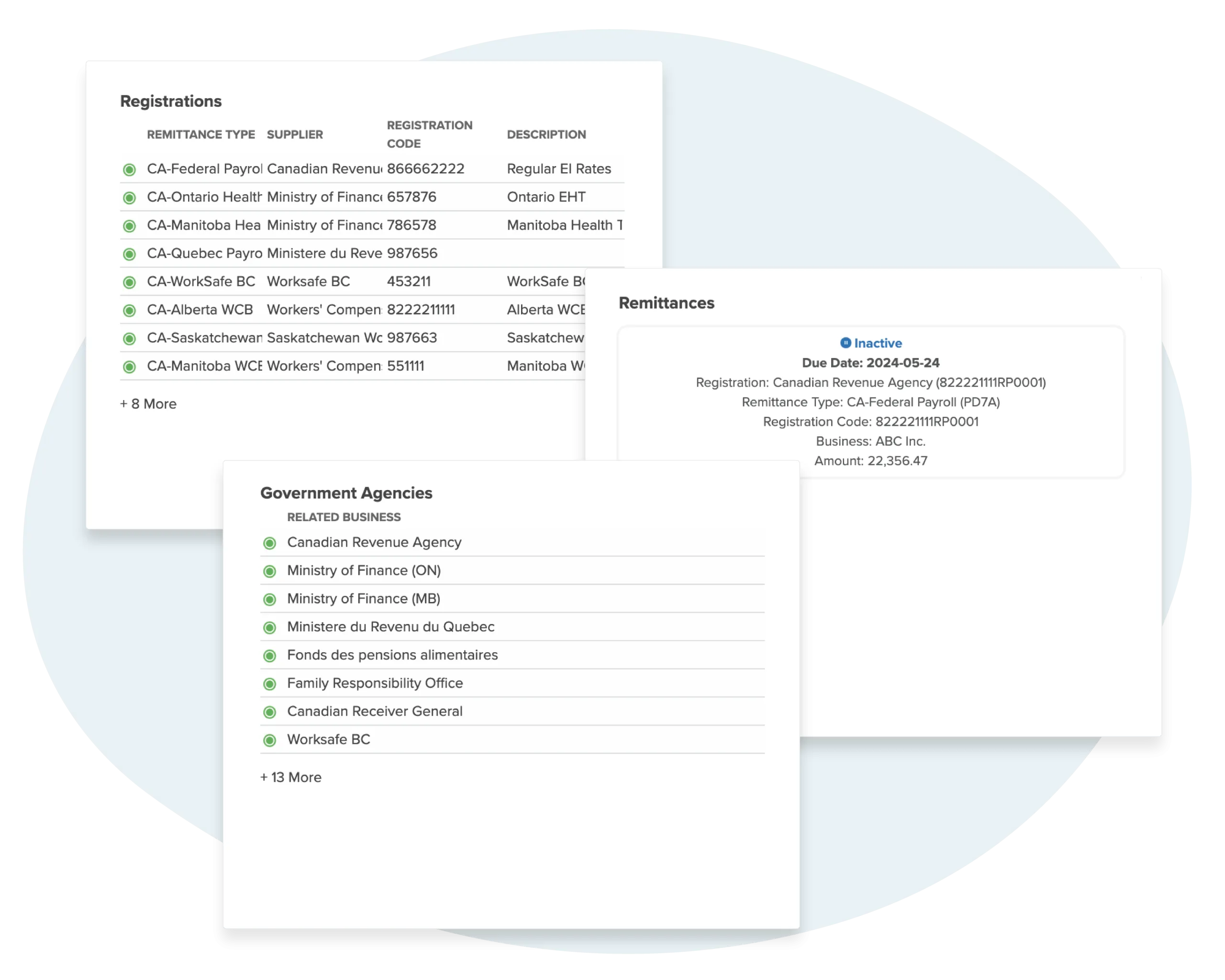

Legislation & Filings Management

Stay compliant and meet deadlines.

Choose to manage your legislative filings independently or take advantage of additional payroll services from Workzoom to relieve pressure and stress on filing deadlines.

Why Workzoom?